- What Must I do First to Obtain Child Support?

- How is Child Support Calculated?

- What Happens if I Already pay Child Support to my First Wife for two Children, and Will Have to pay Child Support to my Soon-to-Be Second Ex-Wife?

- How is net Monthly Income Determined?

- What Economic Resources are Included in net Monthly Income?

- For What Reasons Might the Court Deviate From the Standard Guidelines?

- What About Medical Costs?

- How is Child Support Paid?

Q. What Must I do First to Obtain Child Support?

A. First, a parent or other person must be granted legal custody of the child. The legal custodian of the child, usually a parent, will then be granted child support. The person ordered to pay child support is called an obligor. Custody and child support can both be established in the same proceeding.

Q. How is Child Support Calculated?

A. Generally, child support is calculated by applying guidelines set forth by the Texas Family Code. The guidelines provide that the custodian shall receive 20% of the obligor’s net monthly income using the obligor’s first $8,550 of net monthly income. The percentage increases for more than one child as follows:

2 children – 25%

3 children – 30%

4 children – 35%

5 children – 40%

6 children – at least 40%

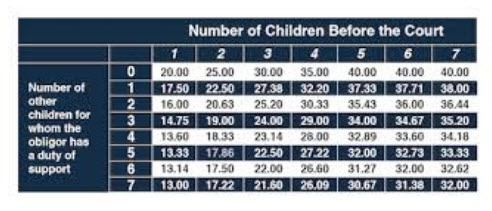

Q. What Happens if I Already pay Child Support to my First Wife for two Children, and Will Have to pay Child Support to my Soon-to-Be Second Ex-Wife?

A. The Court will use slightly different guidelines than those above. Generally the percentages used will be those in the grid below.

Q. How is net Monthly Income Determined?

A. Net monthly income is calculated by adding together all of the obligor’s monthly resources (see below), and deducting the following: social security taxes, federal income taxes (based on the tax rate for a single person claiming one exemption and the standard deduction), state income tax, union dues, health insurance premiums for the child.

Q. What Economic Resources are Included in net Monthly Income?

A. Net monthly income includes overtime pay, wages, salary, tips, bonuses, commissions, interest, dividends, royalty income, self-employment income, net rental income, severance pay, retirement benefits, pensions, trust income, annuities, capital gains, social security benefits, unemployment benefits, disability benefits, workers’ compensation benefits, interest income from notes, gifts, prizes, spousal maintenance and alimony.

Q. For What Reasons Might the Court Deviate From the Standard Guidelines?

A. The Court may deviate from the guidelines if it finds that doing so is in the best interest of the child. Some of the factors the Court may consider are:

- The age and needs of the child;

- The ability of the parents to contribute to the support of the child;

- Any financial resources available for the support of the child;

- The amount of time of possession of and access to a child;

- The amount of the obligee’s net resources, including the earning potential of the obligee if the actual income of the obligee is significantly less than what the obligee could earn because the obligee is intentionally unemployed or underemployed and including an increase or decrease in the income of the obligee or income that may be attributed to the property and assets of the obligee;

- Child care expenses incurred by either party in order to maintain gainful employment;

- Whether either party has the managing conservatorship or actual physical custody of another child;

- The amount of alimony or spousal maintenance actually and currently being paid or received by a party;

- The expenses for a son or daughter for education beyond secondary school;

- Whether the obligor or oblige has an automobile, housing, or other benefits furnished by his or her employer, another person, or a business entity;

- The amount of other deductions from the wage or salary income and from other compensation for personal services of the parties;

- Provision for health care insurance and payment of insured medical expenses;

- Special or extraordinary educational, health care, or other expenses of the parties or of the child;

- The cost of travel in order to exercise possession of and access to a child;

- Positive or negative cash flow from any real and personal property and assets, including a business and investments;

- Debts or debt service assumed by either arty; and

- Any other reason consistent with the best interest of the child, taking into consideration the circumstances of the parents.

A. If health insurance is available through one of the parent’s employment, that parent will be ordered to provide the health insurance for the child. Generally, both parents will be responsible for any of the child’s health costs not paid by insurance, such as co-payments, deductibles and prescriptions.

A. Child support is generally garnished from the obligor’s wages and remitted to the Texas Child Support Disbursement Unit. The Texas Child Support Disbursement Unit then remits the support to the recipient – the obligee.